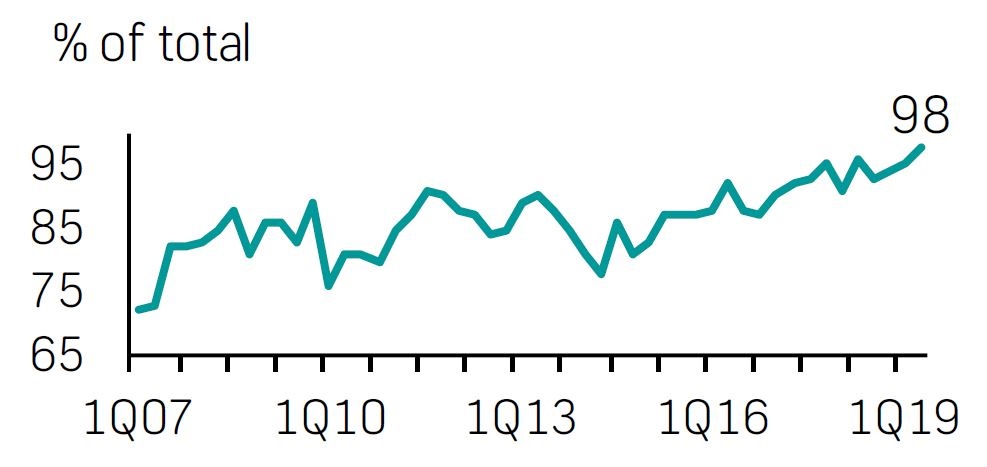

- Only 2% of home-sellers sold their properties for their initial asking price - the worst number since 2007, according to a new FNB survey.

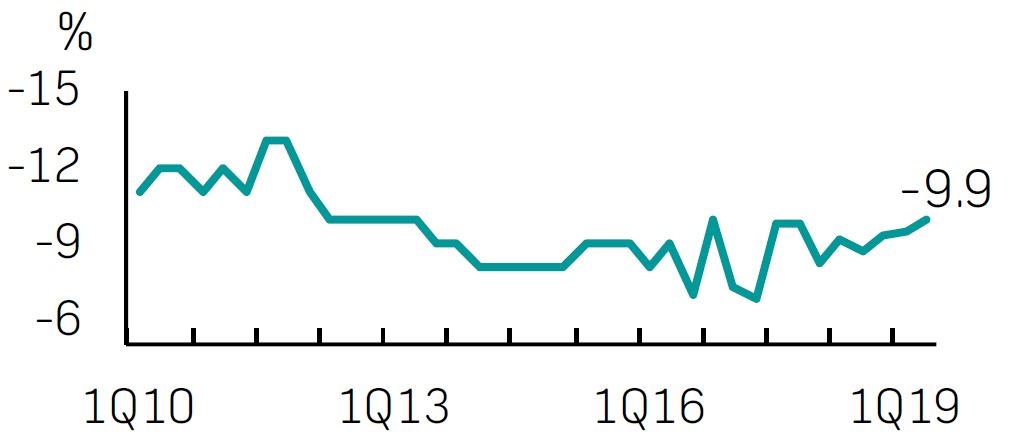

- Sale prices are on average 9.9% below asking prices - and 14% for houses worth more than R3.6 million.

- A fifth of sellers put their properties on the market due to financial difficulties.

- For more stories, go to Business Insider SA.

Only 2% of South African home-sellers sold their properties for their initial asking price, the new FNB property barometer for the second quarter shows.

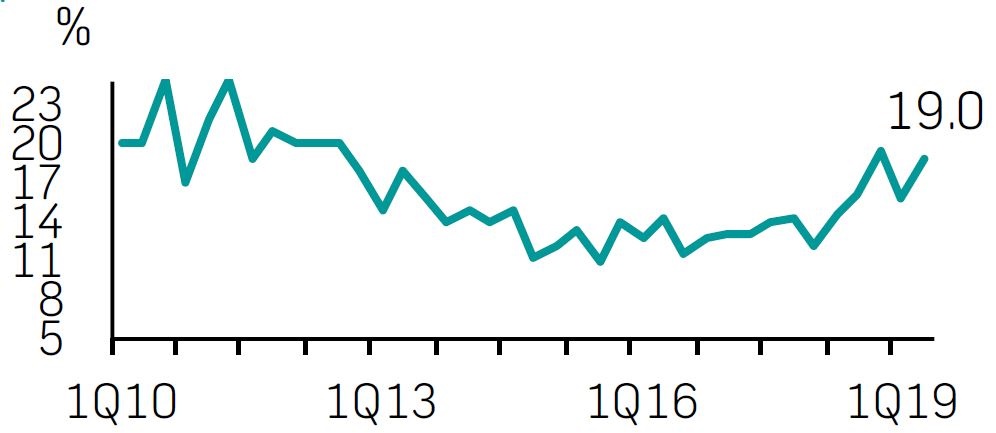

This is the worst performance since 2007:

Selling prices are now on average 9.9% below asking prices - compared to the historical average of 9.0% since 2010.

But for houses of more than R3.6 million, sellers can expect a larger discount of around 14%. A survey among estate agents shows that virtually all properties in this category were sold for less than the initial asking price.

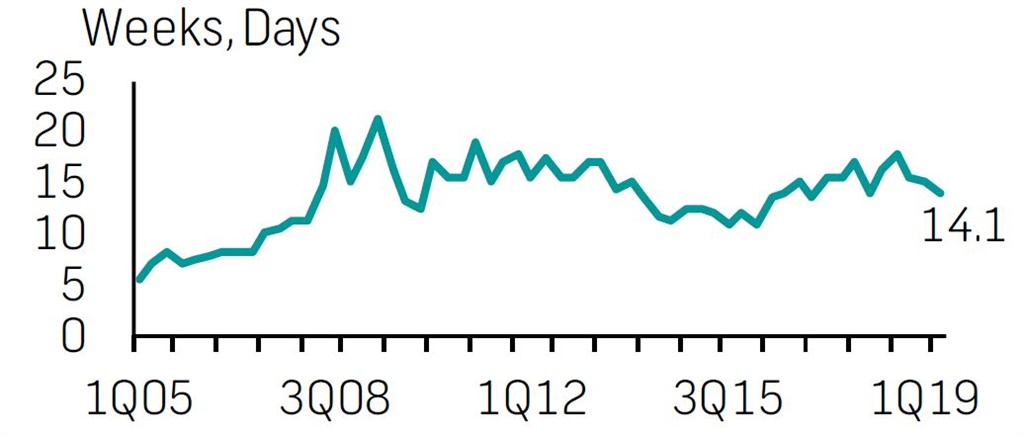

Properties now stay on market for 14 weeks, from 15 weeks at the end of 2018, possibly as buyers rush to take advantage of bargains, says FNB.

This is significantly lower than the most recent peak of 17 weeks and 6 days in the third quarter of 2018 and edging closer to the long-term average of 13 weeks and 4 days.

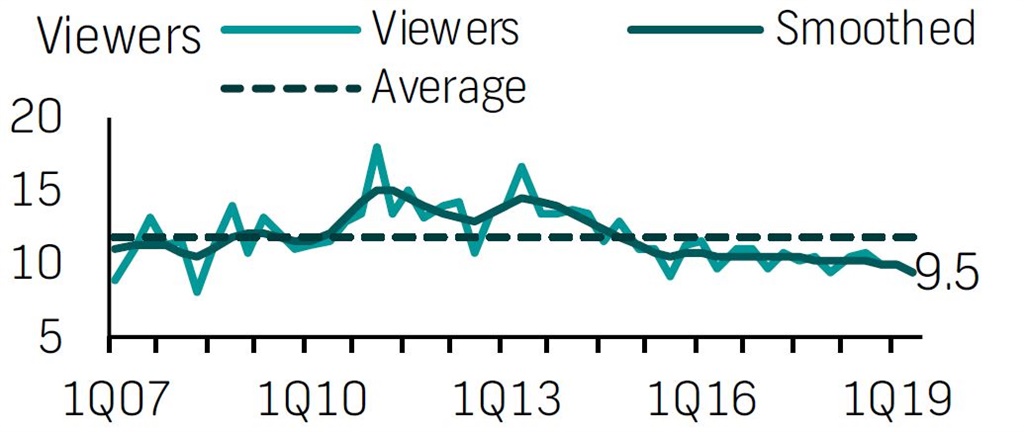

Still, the survey showed that "serious viewers per show house prior to sale" was 9.4 viewers per show house in the second quarter - from almost 12 in 2006.

This suggests that buyer enthusiasm is still relatively slack, says FNB analyst Siphamandla Mkhwanazi.

The new FNB survey shows that almost a fifth of property owners are now selling their houses due to personal financial pressures - up from 16% a year ago.

"This is consistent with our view that household finances are under pressure. Of those who sell due to financial pressure, around 60% now opt for the rental market, as opposed to a cheaper property," says Mkhwanazi.

Emigration-related sales fell from 14.2% in the first quarter to 13.4% in the second quarter.

House prices rose on average by 3.5% in the year to June, from 3.3% y/y in May - still below the inflation rate.

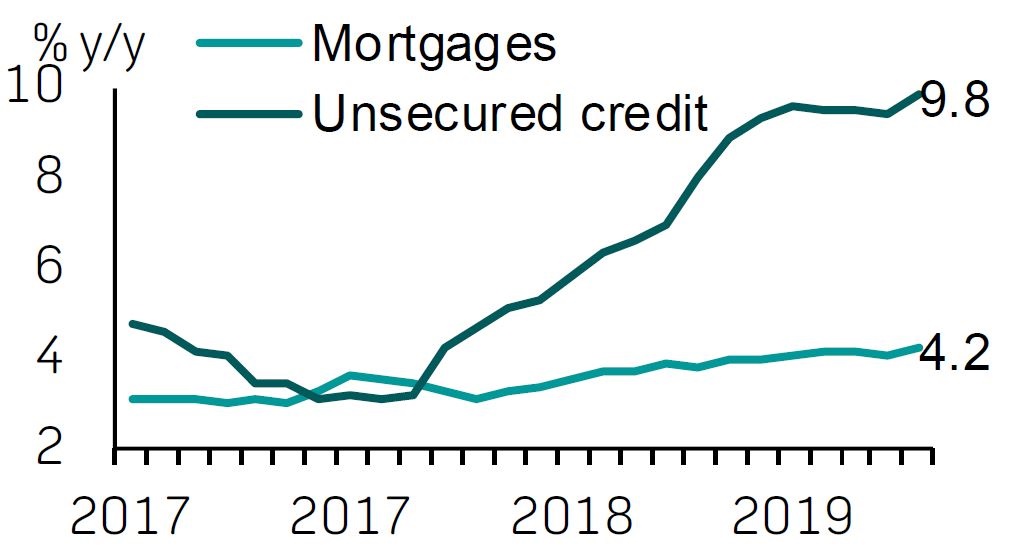

But mortgage advances grew faster in May, with the annual growth rate up 4.2% from 4.0% in the previous month. This is the highest increase since July 2016. "If maintained, this could help support purchasing activity," says Mkhwanazi.

An interest rate cut is expected on July 18th which will also help demand.

"In fact, activity appears to have already picked up after the elections, although not enough to counteract the decline in the months before that," says Mkhwanazi. "This uptick, however, will be countered by rising household income pressures."

FNB expects house prices to rise by only 3.5% this year - still lower than the expected average inflation rate of 4.6%.